Investing your money is one of the widespread ways to gain money. When we are investing our money into something there are some risks which we should take into account and decide whether it worth investing our money or not. Here is an article on Why investing in stocks is not a good idea if you have little money.

Investing in stocks is overrated nowadays. There are some risks and disadvantages of investing in stocks, which we should consider. In this article, I’ll give you information about why investing in stocks is not a good idea, especially in those cases when you have little money.

What are stocks?

Until I go into details, why stocks aren’t worth investing while having little money, I’m going to give you some basic information about them and how they work.

Stocks are a way for earning money. When you invest in stocks that means you are owning a certain amount of shares of the company. So, you are completely dependent on the development of the company. Investing in stocks doesn’t necessarily (and mostly) mean that you will be involved in the processes which are conducted in the invested company.

Companies, which take your invested money in stocks, are using it for various initiatives. After taking some kind of changes and getting initiatives you (as well company) are dependent on how it will work, which is kind of a time-stretched process.

So, we see what are stocks and how they work in general. Now, let’s see what are the main disadvantages of investing in stocks and whether it’s worth investing in them with little money or not.

Disadvantages of investing in stocks

Firstly, one of the main disadvantages of investing in stocks is that there is a high possibility for the company that you are investing in to go bankrupt. And in that case, it’s a huge chance of seeing loss. Usually, stockholders are the last ones who are paid. So, if the company goes broke, you will be the one who will see any profit from the company you invested in.

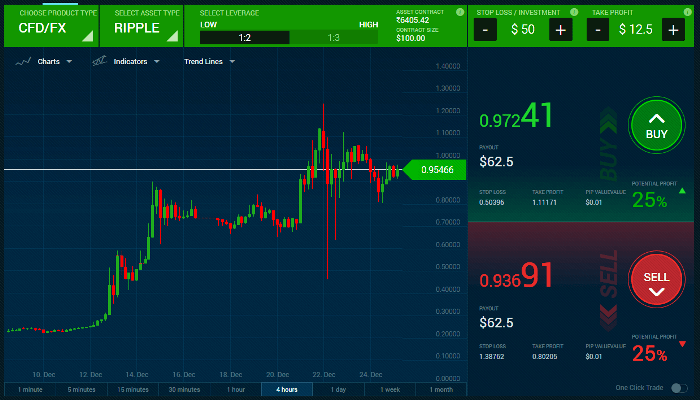

The second and one of the crucial reasons why you shouldn’t invest in stocks while having little money is that stock brokers rarely provide trading on the margin, and even if they do – the available leverage tends to be rather low. On average, the leverage offered by the stock brokers ranges between 2:1 and 5:1. This is one of the main differences between Forex and Stocks and that is one of the main reasons, why people with little money prefer to invest not in stocks but in the currency market, where brokers provide much larger financial leverage – often as high as 50:1.

What’s more, on the stock market many professionals have years of experience of trading with stocks and a lot of knowledge about stock trading. So, if you’re a newbie, particularly with a little money, it’s not a good idea to invest in stocks, because there is a high probability of seeing loss.

So, if there are so many disadvantages of investing in stocks with a little money, what can be the alternative? I’ll discuss it in the next topic.

Getting rich without investing in stocks

The stock market is not the only marketplace where people can invest in and gain money. The much better way to gain money with little finances is to invest in Forex trading. Here are some legit reasons why you should prefer investing in FX over investing in stocks.

Firstly, Forex allows traders to gain money in the short-term, while there are stocks with highly time-stretched processes. People always intend to gain as much money as possible in a short time. Forex trading permits traders with better liquidity, so the chances of gaining money in a small-time are quite high.

The second is that Forex trading is more easily accessible for beginners, than stock trading. This means, even if you are a newbie, it’s much easier to orient and understand things that will help you to gain money.

The third and one of the significant differences between stock trading and FX trading is leverage. With the help of leverage, traders can gain more money in the short-term, and what’s the most important with a little money.

Should I invest in stocks with a little money?

Based on the information given above, it seems that investing in stocks, in particular, with little money is not profitable.

While the main purpose of investing in something is gaining money as soon as possible, stocks, in most cases, don’t allow us to make it happen. What’s more, there’s a high risk of losing money, when we invest in companies. Those companies’ stocks that are dependable and guarantee us not to go bankrupt, usually are selling their stocks at extremely high prices. So, if you want to see a noticeable increase from your investment and with little money, it’s not a good idea to invest in stocks.