Whether you want to manage your medical or wedding expenses, personal loans always help to pay off these significant expenditures. Personal loans are unsecured loans taken from licensed money lenders, online brokers like Personal Loan Pro, and financial institutions. It enables you to cover all the financial requirements from medical to education.

This post will target personal loans. We will dive deep into the subject of these loans and their requirements. Let’s get started.

When Do You Need Personal Loans?

Personal loans are the most helpful funds required during emergencies or other necessary needs. But everything has its benefits and side effects as well. Considering these, we will educate you on the best use of personal loans.

Refinancing loan

Many times people don’t even have money to repay the existing loan. In such cases, they can try to get personal loans from Personal Loan Pro . People prefer refinancing their loans when they qualify for lower interest rates because credit scores are now better compared to when they borrowed the loan.

Debt consolidation

Debt consolidation is another reason people choose to go for personal loans. You can take these loans to clear all other high-interest loans.

Medical bills

Medical expenses come your way anytime, and in such conditions, money is the first thing one needs to consider. Personal loans can be your helping hand. It can be approved fast and is unsecured.

Given Below Are Some Application Steps You Need to Know

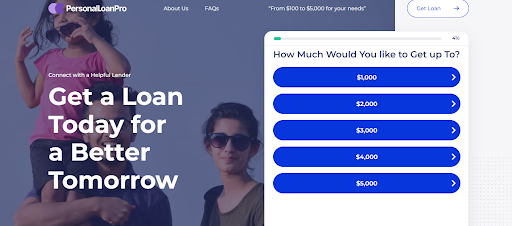

Decide on the money you need

Personal loans help cover different types of finances. So you can consider taking these loans from loan brokers such as Personal Loan Pro. Decide on the income you want to borrow. It is a crucial decision before applying. You need to know that the more money you borrow, the higher the interest rate you have to pay each month.

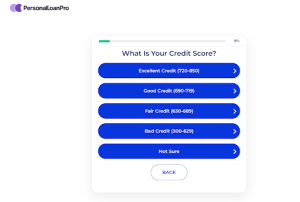

Check on your credit score

After evaluating the money, check your credit score. It’s a vital factor that makes you buy these loans. Find out where you stand, and if you have an excellent credit rating, there is a higher chance of getting a personal loan.

Compare the array of options

Once you have checked your credit score, it’s time to explore different options available when you apply for personal loans. There are multiple types- secured loans, fixed rate, unsecured personal loans, and variable rates. You need to select from them by thoroughly comparing the options.

Check your eligibility

When you apply for any kind of loan, you need to see whether you are eligible for it or not. Check the eligibility criteria of the loan. And make sure you meet all those terms before you apply for the personal loan. In case you fail during the eligibility step, you may not qualify for the loan. So, this is an essential step.

Gather all the documents required

When applying for a personal loan, there is a need for different documents you may have to submit at the time of application. In order to not forget anything, create a complete checklist that conveys the documents needed. It makes you ensure you don’t miss any crucial documents. Once you have created the checklist, go and grab every paper you need.

Submit your application

When you are all set with the documents, it’s time to fill out the application and submit it. You can check online as there are multiple sites available that can help you with the same. Fill in every detail carefully because any mistake can lead to rejection.

Wait for the permission and acquire the funds

Once you have applied for the loan, wait for approval from the lender side. You will get the updates as the lender accepts your application. After this, they will send the amount to your account.

Dos and Don’ts for Applying for the Personal Loan

When you apply for a personal loan, there are certain things you have to consider.

Ensure you meet the payments

When you go for loans, it is a necessity to condition to meet the payments on time. The lender will only provide you with the money when you are capable enough to pay it back. Therefore, it’s necessary to peek at your budget and factor before applying for the loan.

Don’t borrow more than you need

When borrowing a loan, consider you avoid borrowing more than you need. As if you get the higher amount, the more interest you have to pay. It can directly impact your financial well-being.

Don’t give false information

It’s necessary to deliver the correct information to the lenders. They will verify your details. And if you provide false information, you may likely get canceled your loan.

What Are the Requirements for a Personal Loan?

There are a few requirements when you apply for personal loans. You need to provide certain documents, and you have to be eligible for the same.

- Proof of identity is a must requirement when you apply for personal loans.

- Nextly you are required to provide residential proof.

- You need to provide proof of income before applying for the loan.

The Bottom Line!

Personal loans have always been a great help for multiple people who need immediate cash. Whether you are in a medical emergency or another emergency, a personal loan can be the best solution.

We have provided you with complete information on the steps you have to follow in order to get these loans. Personal Loans Pro can be your helping hand when you are in the need of personal loans. They have helped millions of people already. So, it’s your time to get the loans when in need.