The Turkish real estate market has emerged as a lucrative investment destination, offering high returns driven by surging demand and solid capital appreciation. This article provides a comprehensive guide to investing in Turkish real estate, analyzing market dynamics, legal frameworks, investment strategies, and risk management.

Brief Overview of the Turkish Property Market

Turkey’s real estate sector has seen exponential growth in recent years, with property values in Istanbul rising by over 200% since 2010. Rapid urbanization, tourism expansion, and a thriving economy have fueled real estate demand. The market has begun cooling down after years of overheating, but still promises attractive returns.

Historical Performance

The early 2000s saw massive construction booms and soaring property prices, catalyzed by tourism growth and foreign buyer interest. Prices climbed steadily until 2018 when the market started slowing due to currency fluctuations and global economic uncertainties. Despite some stabilization recently, YoY returns still range from 5-15% depending on location.

Current Trends and Developments

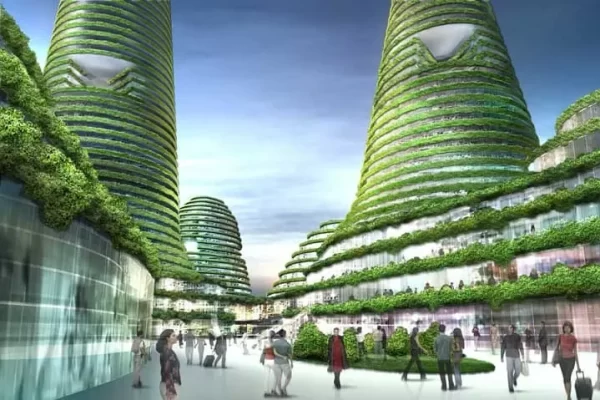

While sales volumes have moderated, housing demand remains robust in major cities like Istanbul, Antalya, and Ankara. Developers are focusing more on mid-tier affordable projects. With over 1 million foreign home sales in the last 5 years, both residential and commercial real estate draw steady overseas interest.

Unveiling the Attraction

Economic Growth and Investment Opportunities

Turkey’s strong economic fundamentals, growing middle class, and demographic dividend create a sturdy backbone for real estate growth. The economy rebounded strongly from the pandemic with over 11% GDP growth in 2021. With inflation stabilizing and the Lira regaining strength, investor sentiment has improved.

Legislative Framework Supporting Foreign Investment

Reforms in recent years have made the Turkish property market more accessible to foreign buyers. The reciprocity law introduced in 2012 allows buyers from several countries to purchase real estate in Turkey. The government also provides citizenship to foreign investors through a $250,000 investment in real estate.

Lifestyle and Cultural Appeals

Turkey’s unique culture, cuisine, and natural beauty make it a desirable destination. Istanbul’s eclectic mix of history and modernity attracts real estate investors seeking second homes or retirement properties. Coastal regions like Bodrum and Antalya also draw buyers looking for vacation homes.

Geographical and Climate Perks

Turkey enjoys diverse climatic zones, clean beaches, majestic mountains, and scenic landscapes. The Mediterranean and Aegean coasts offer an appealing year-round climate. Istanbul provides four-season living amidst historic sites. These locational advantages raise real estate values significantly.

Decoding the Legalities

Foreign Ownership Laws in Turkey

In 2003, Turkey lifted restrictions on foreign property ownership with some reciprocity conditions. Currently, over 180 nationalities can buy freehold property in Turkey after obtaining a tax number. The only restriction is on buying more than 30 hectares of land per person.

Investment Regulations and Compliance

Investment processes are streamlined, with no pre-approvals required. Foreign individuals and companies only need to provide standard identification and incorporate locally to buy commercial property. Funds can be easily repatriated, providing investor flexibility.

Taxation: Understanding Tax Liabilities and Advantages

Foreign buyers are subject to 18% VAT, 1-3% title deed fee, and 22% income tax on rental income. Capital gains tax was recently waived, enhancing returns for investors focused on price appreciation. Overall, taxes are lower compared to other European countries.

Navigating through Purchase Procedures and Documentation

The buying process is straightforward and can be completed within 1-2 months with correct documentation. Typical documents include passports, tax numbers, purchase contracts, and bank receipts. Hiring a reputed solicitor fluent in Turkish regulations can expedite procedures.

Strategic Market Analysis

Identifying Potential Regions for Investment

Istanbul, Antalya, Ankara, Izmir, and Bursa are the most promising markets currently, with strong housing demand and solid infrastructure. Istanbul offers diverse investment opportunities, while coastal cities attract tourism-driven demand.

Market Dynamics: Supply and Demand

Demand continues to outpace supply, especially in Istanbul where over 500,000 new inhabitants arrive annually. But massive construction pipelines may soon lead to oversupply in some areas. Investors must assess localized demand-supply metrics before investing.

Economic Indicators and Their Impact on Property Value

robust GDP growth, urbanization, tourism revenues and FDI inflows positively impact real estate. Currency stability, inflation, interest rates, and credit availability also determine buyer access to mortgages. Monitoring these indicators is vital.

Risk Management: Economic, Political, and Environmental Factors

While Turkey’s economy appears resilient, Lira volatility and global headwinds like rising oil prices can create turbulence. Turkey’s geopolitical position also engenders some instability risks. Environmental risks like floods and earthquakes are also considerations for investors.

Portfolio Diversification within Turkish Property

- Residential Investments: Apartments and Villas. Istanbul apartments yield 5-7% returns from rentals and enjoy high capital appreciation. Seaside villas are popular vacation rentals earning USD 15,000-30,000 per week. Branded residences by luxury chains like Mandarin Oriental also provide options.

- Commercial Investments: Offices and Retail Spaces. Grade A offices in central Istanbul lease at $30 per sqm per month, with 7-10% yields. Malls and street retail target Turkey’s young population. Commercial spaces also enable mixed-use development.

- Tourism-Driven Investments: Hotels and Resorts. Coastal resorts and hotels earn rental incomes while benefiting from Turkey’s booming tourism. Occupancy rates around 65% provide satisfactory returns on investment.

- Agricultural and Industrial Property Investments. Warehouses, factories, and agricultural land present longer-term plays on Turkey’s infrastructure and productivity growth. However, lower liquidity calls for careful evaluation.

Maximizing Returns and Managing Risks

Analyzing Return on Investment (ROI) in Different Segments

Expected returns vary from 5-10% on residential assets to 10-15% for commercial investments. However, higher yields require assuming greater risk. Market research and financial analysis are key to determining optimal asset mix and location.

Mitigating Risks through Thorough Due Diligence

In addition to macroeconomic indicators, investors must assess project developer reputation, construction quality, and localized demand dynamics before investing. Legal due diligence to validate deed and ownership is also essential.

Leveraging Local Expertise and Partnerships

Turkish developers and real estate agencies provide valuable on-ground intelligence and project access. Local partners can also help navigate legal complexities. Reputed Turkey-based law firms provide critical support.

Ongoing Management and Maintenance of Properties

Outsourcing specialized property management enhances occupancy rates and rental incomes. Well-maintained properties also gain value faster. Investors must budget for insurance, renovations, vacancies, and other costs.

Conclusion

Turkey presents an exciting real estate investment destination, with high historical returns. But the market is maturing, warranting greater prudence in project selection and entry valuations to ensure profitable investing.

Future Perspective of the Turkish Property Market

If Turkey sustains its economic recovery and focuses on infrastructure development, the property market will likely continue growing. But macroeconomic stability, demand-supply equilibrium, and sound regulation will determine future success.

Turkish real estate has strong fundamentals and upside potential. However, investors must conduct rigorous due diligence, manage risks proactively, and tap local intelligence to build a profitable portfolio. Long-term perspectives and active asset management will deliver enduring rewards.