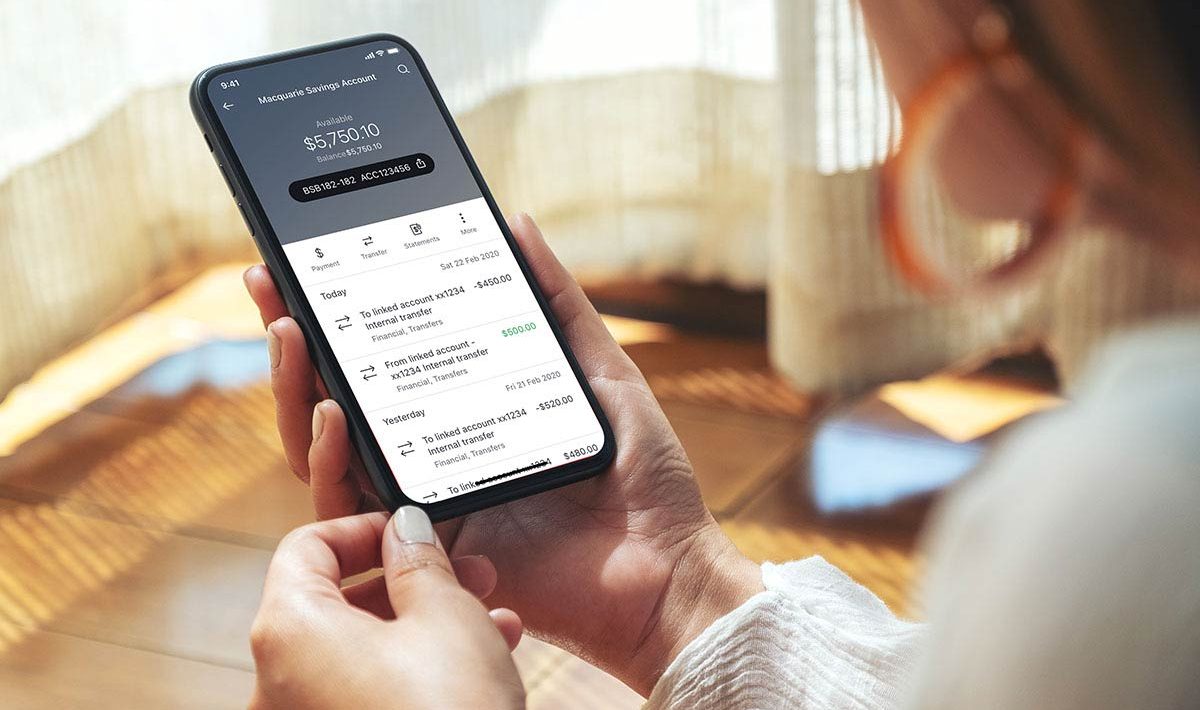

Mobile banking isn’t just a trend. That should be a reflection of new user needs. This is the time when understanding intuitive design is crucial. Banking service doesn’t provide value without the mobile app.

Why Mobile Banking App UI Matters

The smartphone screen is a battleground where apps vie for user attention, trust, and retention. In this arena, mobile banking apps bear an extra burden. They must be functional. And at the same time, they must also convey trustworthiness, security, and simplicity. Every interface element and every interaction underlines the profound importance of impeccable UI design.

When users launch a banking app, they’re not just looking for functionality; they’re seeking a seamless experience. Every touch, swipe, or tap on a mobile banking app sends a clear message about the brand behind it.

First Impressions: A sleek, intuitive UI fosters user trust and ensures repeated visits.

Trust and Confidence: With monetary transactions involved, users must believe that their data is safe and transactions are seamless.

For example, PayPal. Its interface is simple and secure. It makes users trust. First impressions count, and a trustworthy UI ensures they count right.

There are a lot of nuances in a perfect mobile app interface. Some secrets were revealed in the mobile banking app UI design blog.

Principles of High-Usability Design for Mobile Banking

While the app stores are flooded with applications. Only some truly resonate with users. This resonance is often not a product of sheer luck but a result of diligently applied design principles. Ensuring that a mobile banking app is not just functional but also intuitive, engaging, and delightful demands are foundational principles of design.

Apps with clarity, consistency, and user-centricity float to the top.

Clear Hierarchical Structure: Streamlining navigation by prioritizing vital features ensures users can complete their tasks efficiently.

Consistency: Uniformity in design elements like buttons, icons, and color schemes fosters familiarity.

Intuitive Icons and Elements: Using symbols that resonate universally eradicates ambiguity.

Responsive Design: A user-friendly interface should adapt across various devices without compromising on experience.

Feedback Mechanisms: Immediate responses, be it a successful transaction or an error message, keep the user informed and engaged.

Chime is a mobile banking platform. It became popular thanks to its user-friendly design. The interface makes it easier to use different complex features.

Crafting a successful mobile banking UI boils down to understanding and applying core design principles.

Common Pitfalls & How to Avoid Them

The journey to crafting a stellar mobile banking app interface has some pitfalls. Some are evident, while others only reveal themselves through user interactions. Navigating this path requires not just an awareness of these challenges. But also strategies to avoid them. It’s about challenges and designing solutions even before they start.

Each app has challenges. Here are some of them:

Over-cluttering the UI: It’s tempting to integrate every feature, but minimalism is the key. Offer only what’s essential and ensure it works flawlessly.

Ignoring the User Journey: Regular user testing can provide insights into user preferences and pain points.

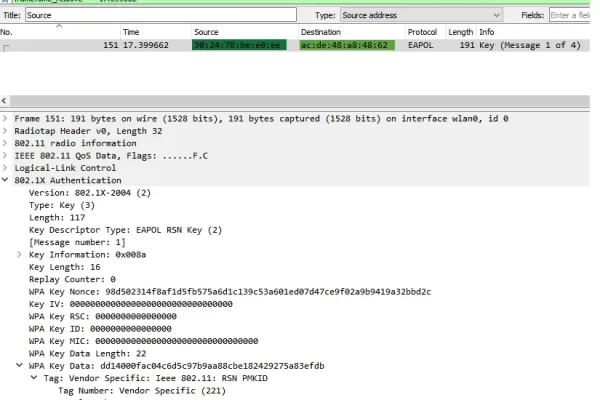

Overlooking Security Indicators: Icons indicating encryption or verified transactions reinforce user confidence.

Robinhood, while loved for its simplicity, faced backlash for not providing enough user feedback during critical operations.

Avoiding pitfalls is about striking the right balance between innovation and intuitive design.

Designing for the Future

Founders need to adapt and innovate. We need to weave new solutions into the existing design smoothly. At the same time, keep the application modern and future-oriented.

Innovation is ceaseless, but so is the demand for familiarity.

Integrating AI and Chatbots: While automation is crucial, balancing it with a personal touch ensures users don’t feel alienated.

Biometric Authentications: Implementing fingerprint or facial recognition features not only enhances security but also expedites the transaction process.

Dark Mode and Customizable UI Themes: Empowering users to customize their app experience can lead to increased satisfaction and prolonged usage.

Square, a payment solution, regularly integrates futuristic elements like AR into its interface while ensuring the core UI remains familiar. The challenge lies in harmonizing the new with the known.

Embracing Accessibility in Mobile Banking UI

One aspect stands out as not just a priority but a responsibility: accessibility. A truly great mobile banking app is usable by everyone, including those with disabilities. Products must cater to the diverse spectrum of user needs.

Take voice-command features, for instance. They’re not just a futuristic addition. This is a vital function for those who cannot navigate traditionally. Or consider color contrast ratios. Users with visual impairments need to distinguish between elements. These nuances can shape a user’s experience. And also determine the true universality of an app.

Founders not only expand their user base but also underscore a commitment to equality in the digital realm. It’s about ensuring that technology, especially something as crucial as mobile banking, remains an enabler for all. It should ruin barriers and set new standards in inclusive design.

Success Stories

Behind every triumphant mobile banking app lies a tale of challenges, innovation, and relentless focus on user experience. These stories serve as both inspiration and a roadmap. They highlight the potential rewards of prioritizing user-centric design. And show strategies for success.

Take “BankSaaS Pro”, a cloud-based accounting platform. They integrated a mobile banking module with an immaculate UI. Which balanced feature-richness with simplicity. Within months, user retention rates soared by 40%. Their secret? Regular user feedback sessions. Plus, a dedicated design team that kept the user at the center of every decision.

True success in the banking realm is birthed not just from technical prowess. It lies in a genuine dedication to serving and understanding the user.

Staying ahead in the competitive finance arena means constantly evolving. For founders, this evolution isn’t just about adding new features but ensuring that each added feature complements the existing ecosystem. Embracing the principles of user-friendly mobile banking UI design isn’t a choice—it’s the future.