Cryptocurrencies have become a dynamic and rapidly evolving space within the financial sector. As the market continues to mature, keeping abreast of the latest developments is crucial for investors and enthusiasts alike. This article aims to provide a comprehensive guide to the newest cryptocurrency coins, exploring their emergence, characteristics, notable examples, risks, investment strategies, technological innovations, community influence, and a glimpse into the future. Explore more now and read about the potential of Bitcoin in online digital notary services. Read on!

What Makes a Cryptocurrency “Emerging”

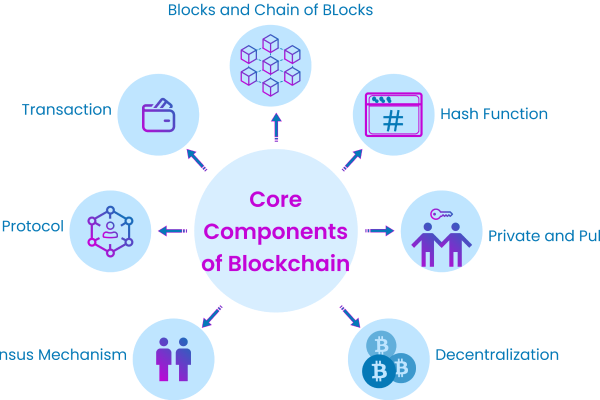

Newly introduced cryptocurrencies, known as emerging coins, distinguish themselves by their recent introduction to the market and incorporation of innovative features. These digital currencies frequently utilize cutting-edge technologies like blockchain and smart contracts to tackle distinct challenges or provide unconventional solutions. The rise of emerging cryptocurrencies is driven by a confluence of factors, including rapid technological advancements, evolving market trends, and a growing demand for specialized functionalities within the digital asset space.

Notable Emerging Cryptocurrencies

Several cryptocurrencies have garnered attention in recent times, each carving its niche through distinctive attributes and promising market potential. Notably, Coin A differentiates itself through pioneering technology, showcasing features that distinguish it from established counterparts, such as heightened security, scalability, or enhanced privacy features. Meanwhile, Coin B earns recognition by virtue of robust community support and practical use cases. Community-driven initiatives underscore a solid foundation and an actively engaged user base, pivotal factors in the coin’s overall success. Coin C stands out through its market potential and strategic partnerships, emphasizing the profound impact that collaborations with established entities or industries can have on a cryptocurrency’s adoption and intrinsic value.

Risks and Challenges

Investing in emerging cryptocurrencies presents enticing prospects, yet it necessitates astute navigation through a spectrum of risks and challenges. The inherent volatility of the market introduces the potential for substantial price fluctuations, underscoring the importance of a cautious investment approach. Addressing security apprehensions and the prevalence of scams requires diligent due diligence. Additionally, the regulatory landscape’s uncertainties wield influence over the destiny of new cryptocurrencies, introducing legal complexities and compliance considerations that investors should carefully weigh.

Investment Strategies

Investing in emerging cryptocurrencies requires a strategic approach to mitigate risks and optimize returns. Thorough research into the technology, team, and use cases of a coin is essential before making any investment decisions. Diversification across multiple cryptocurrencies can help manage risks effectively, while the choice between long-term and short-term investments depends on individual risk tolerance and financial goals.

Technological Innovations in Emerging Cryptocurrencies

Emerging cryptocurrencies often introduce technological innovations that push the boundaries of what is possible within the blockchain space. Advancements in blockchain technology enhance security, scalability, and interoperability. Smart contract capabilities automate and enforce the terms of agreements, enabling a wide range of decentralized applications. Some emerging coins even integrate artificial intelligence and the Internet of Things, further expanding their use cases and potential impact.

The Role of Community in Shaping Emerging Cryptocurrencies

The success of emerging cryptocurrencies is intricately tied to the active engagement of their communities, which serves as a catalyst for innovation, resilience, and organic growth. Projects led by passionate communities showcase the immense power of collective efforts, particularly in areas such as development, marketing, and adoption. Examining successful case studies underscores the pivotal role played by communities in shaping the destiny of emerging coins. Social media platforms and online forums emerge as crucial arenas where community-driven narratives significantly influence public perceptions, thereby steering the trajectory of these burgeoning digital assets.

Future Outlook

Predicting the future of emerging cryptocurrencies involves analyzing current trends and anticipating market dynamics. While challenges such as regulatory uncertainties persist, opportunities for growth and development also emerge. The evolving role of these coins within the broader cryptocurrency ecosystem will likely see increased integration into traditional finance and further technological advancements.

Conclusion

In conclusion, the world of emerging cryptocurrencies offers both opportunities and challenges. Navigating this space requires diligence, strategic thinking, and an understanding of the dynamic nature of the market. As technological innovations continue and communities drive the evolution of these coins, the cryptocurrency landscape is set to witness exciting developments. Investors and enthusiasts alike should approach this space with a balanced perspective, acknowledging the potential for innovation while remaining aware of the inherent risks.