In the ever-evolving landscape of the financial world, there exists a fascinating intersection between two seemingly distinct domains: cryptocurrency mining and the foreign exchange market. The advent of cryptocurrencies has ushered in a digital revolution, providing innovative opportunities for both individual and institutional investors. One such avenue for wealth generation is through the process of crypto mining. Additionally, the Forex market, also known as the foreign exchange market, offers a platform for trading traditional fiat currencies. In this article, we will delve into the intriguing relationship between crypto mining and Forex, exploring how they intertwine and influence each other. By understanding how cryptocurrencies and traditional currencies intersect, and by choosing the right trading platform like Trade Edge Ai, individuals can harness the opportunities presented by this fascinating convergence.

The Intersection of Two Worlds

Cryptocurrency Mining: A Source of Digital Gold

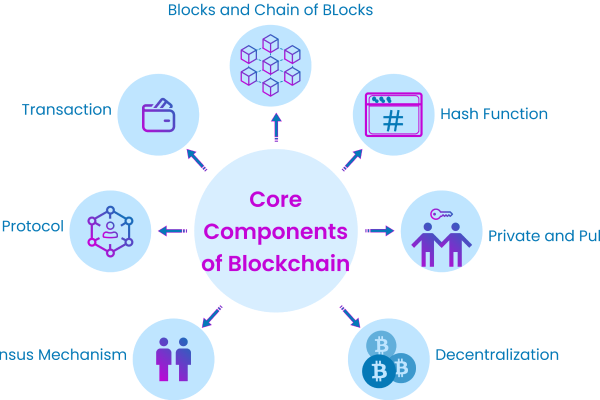

Cryptocurrency mining is a process where individuals or groups validate transactions on a blockchain network using computational power, for which they are rewarded with newly minted digital tokens. The most well-known cryptocurrency, Bitcoin, is often mined by dedicated miners who solve complex mathematical puzzles to add new blocks to the blockchain. Here are some key points to understand about crypto mining:

- Mining Power: Mining requires specialized hardware, known as mining rigs, that are designed to perform the complex computations needed to validate transactions.

- Decentralization: The decentralized nature of blockchain networks is one of their most attractive features. It means no single entity has control over the network, and transactions are transparent.

- Incentives: Miners are motivated by the rewards they receive in the form of cryptocurrency, such as Bitcoin, Ethereum, or others, along with transaction fees.

Forex: The Traditional Currency Market

The Forex market, on the other hand, deals with the exchange of traditional fiat currencies, like the US Dollar, Euro, or Japanese Yen. It is the largest and most liquid financial market globally, boasting a daily trading volume in the trillions of dollars. Forex trading involves speculating on the exchange rate between two currencies, buying one while simultaneously selling the other. Here are some key points to understand about Forex:

- Currency Pairs: In Forex trading, currencies are quoted in pairs, such as EUR/USD, GBP/JPY, or AUD/CAD, where one currency is exchanged for another.

- Leverage: Traders often use leverage, a borrowed capital, to amplify their trading position, which can increase both profits and losses.

- Market Hours: The Forex market operates 24 hours a day, five days a week, allowing traders to engage in global transactions during different time zones.

The Synergy Between Crypto Mining and Forex

While these two financial realms may seem worlds apart, they share a common thread: profitability and investment potential. Let’s explore the connections and synergies between crypto mining and Forex trading.

- Hedging with Cryptocurrencies: Cryptocurrencies, such as Bitcoin, have gained recognition as a hedge against inflation and economic instability. Savvy Forex traders often incorporate cryptocurrencies into their portfolios to diversify and protect their investments.

- Crypto as a Forex Trading Pair: Some Forex brokers now offer cryptocurrency pairs, enabling traders to speculate on the exchange rate of cryptocurrencies against traditional fiat currencies. For example, you can trade BTC/USD, allowing you to capitalize on Bitcoin’s price movements against the US Dollar.

- Cross-Asset Portfolio Management: Experienced investors leverage their crypto mining profits to invest in Forex, diversifying their holdings and optimizing returns. This strategy is particularly appealing to those who believe in both the long-term potential of cryptocurrencies and the stability of traditional currencies.

- Risk Management: The volatility inherent in both the crypto and Forex markets allows for strategic risk management. Traders can employ various strategies to mitigate risks while optimizing returns, further blurring the line between these financial realms.

Conclusion

As the world of finance continues to evolve, the connection between crypto mining and Forex trading becomes more evident. Investors seeking to diversify their portfolios and maximize profits can explore the potential synergies between these two financial realms. Whether you’re a crypto miner looking to explore Forex or a Forex trader considering cryptocurrency investments, the possibilities are as endless as the digital realm itself. Embrace the future of finance and take advantage of this unique intersection to mint your own financial success.