Investing in cryptocurrency can be a lucrative option for investors. However, it can also be risky. Cryptocurrencies are volatile and may be subject to manipulation and scams.

Investing in cryptocurrency has risks, but there are also compelling reasons to consider it. This article will discuss the impact of investing in cryptocurrency on the world.

Accessibility

Many traditional investment platforms and brokerages now offer consumers the option of cryptocurrency. These options typically have lower trading costs than cryptocurrency exchanges. However, they can’t provide access to crypto held in private or cold wallets, which may be frustrating for experienced investors.

1.7 billion people worldwide need bank accounts or adequate financial resources. Cryptocurrency allows them to invest and send money anywhere worldwide without worrying about business hours, traditional currency conversions, or expensive international wire transfers.

Investing in cryptocurrency offers a fresh opportunity for potential returns and can aid in diversifying an investor’s portfolio, particularly for those interested in ESG investments. ESG investments integrate environmental, social, and governance issues with financial ones.

Liquidity

When investing in any asset, liquidity is a crucial consideration. Without it, investors cannot easily buy or sell their investments. Liquidity can also affect investment returns. For example, stocks with higher bid-ask spreads tend to yield lower monthly returns than those with the lowest spreads.

Cryptocurrencies offer high levels of liquidity. Investors can purchase cryptocurrencies easily and quickly on exchanges. Additionally, cryptocurrencies can be stored in Current online wallets.

Another concern is the risk of a cryptocurrency liquidity crisis. A liquidity crisis can cause many investors to lose their investments. The issue can stem from market manipulation, such as pump and dump strategies. Management issues, including deceptive practices or unethical behavior, can also cause it.

Transparency

Unlike traditional investments, cryptocurrency is not subject to the whims of specific companies or countries. Cryptocurrency is its master, making it a powerful tool for individuals in various financial circumstances.

Investors have been able to reap hefty returns from these assets. However, it’s important to note that past returns don’t predict future performance.

Moreover, cryptocurrencies provide a level of transparency that’s typically not available with other investments. This transparency helps investors make more informed decisions. It also prevents investors from being stung by bad actors and scams. This is essential for ESG investors looking to improve their portfolios while supporting small businesses and global causes.

Security

For many, cryptocurrency is a way to invest without having access to traditional investment accounts. However, the risk and volatility associated with crypto is high.

Cryptocurrency prices can plunge dramatically, wiping out hundreds of billions in investments. This volatility makes the asset class one of the most high-risk investments on the market.

There are also risks associated with the technology that supports cryptocurrencies. Some exchanges are vulnerable to hacking, while others may fail.

Investors should carefully consider the reward-to-risk ratio before making any decisions. They should only invest what they can afford to lose. They should also understand the unique tax implications of this new investment class. Lastly, they should research and seek the advice of an investment professional.

Privacy

Cryptocurrencies are a way to make investments without the need for third parties. They can also be transferred instantly between individuals.

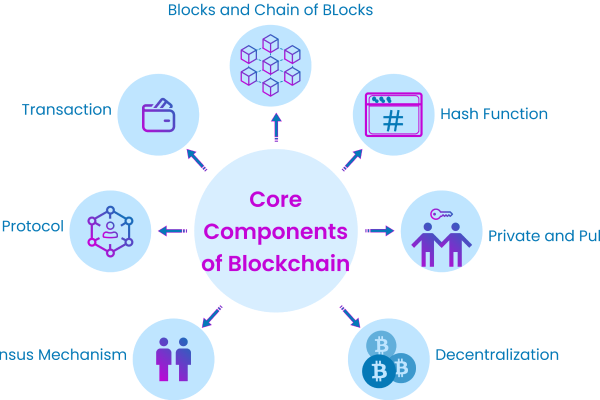

Blockchain technology helps keep cryptocurrency transactions private by obscuring wallet addresses. However, that does not mean cryptocurrencies are entirely anonymous.