Bitcoin and other cryptocurrencies present a revolutionary approach to financial transactions, one that eliminates the need for central banking systems and national borders. They are built upon distributed ledger technology, or blockchain, which ensures secure and transparent transactions. The use of such decentralized currencies has significant implications for the global economy, potentially enabling smoother international trade and financial inclusivity. Immediate Momentum is one of the best platforms for gaining information.

However, the borderless nature of cryptocurrencies also presents challenges. Regulatory frameworks vary significantly across nations, and the anonymity offered by these digital currencies can potentially facilitate illicit transactions. Moreover, the potential for market manipulation and the volatility of these assets further complicate their integration into mainstream financial systems.

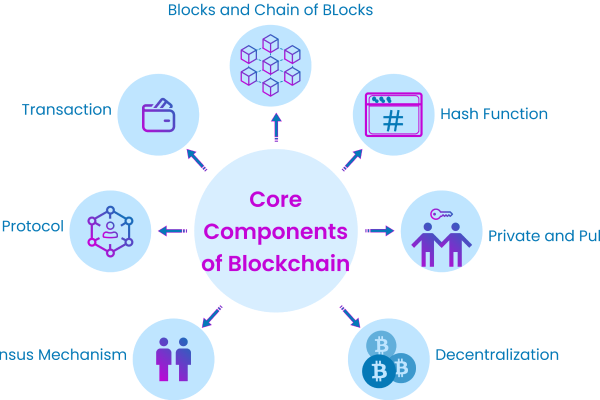

Despite these challenges, the ethos behind Bitcoin, as outlined in its ‘manifesto’ by the pseudonymous creator Satoshi Nakamoto, is one of financial freedom and decentralisation. It advocates an economy where financial control is taken away from centralised authorities and given back to individuals. The implications of such a scenario are profound and far-reaching, prompting ongoing discussions among economists, technologists, and policymakers.

What is a Bitcoin wallet?

A Bitcoin wallet is a digital storage service for the cryptocurrency Bitcoin. Unlike a physical wallet, a Bitcoin wallet does not actually store Bitcoin. Instead, it holds the digital credentials, or keys, necessary to access Bitcoin addresses and carry out transactions. These wallets can be software-based, existing on a user’s computer or mobile device, or hardware-based, stored on separate physical devices for added security.

Creating a Bitcoin wallet entails generating a private key and a corresponding public key. The private key, kept secret by the user, allows access to the wallet and facilitates transactions. The public key, on the other hand, serves as an address to which others can send Bitcoin. It’s crucial that the private key is secured and backup as its loss results in an irreversible loss of the Bitcoins associated with it.

There are various types of Bitcoin wallets including mobile, desktop, web, and hardware wallets. Mobile and desktop wallets are software applications downloaded onto devices, offering convenient access but posing potential security risks. Web wallets, accessible via the internet, provide flexibility but also depend on third-party trust. Hardware wallets, representing the most secure option, store private keys on a dedicated device, isolated from the internet and potential threats.

What is the difference between a hot wallet and a cold wallet?

A hot wallet is a type of Bitcoin wallet that is connected to the internet. This connection allows for instant access to the cryptocurrency, making it an ideal choice for frequent transactions and trading on cryptocurrency exchanges. However, this convenience comes at the cost of security. Since hot wallets are connected to the internet, they are susceptible to hacks, malware, and other online threats.

In contrast, a cold wallet is not connected to the internet. This type of wallet stores the user’s private keys offline, providing an additional layer of protection against online threats. Cold wallets, which include hardware wallets and paper wallets, are a popular choice for storing large amounts of Bitcoin due to their enhanced security features. However, they may not offer the same level of convenience as hot wallets for frequent transactions.

Both hot and cold wallets have their own advantages and trade-offs. The choice between the two often depends on the individual’s specific needs and circumstances. Those who transact or trade frequently may prefer the convenience of hot wallets, while those looking to store their Bitcoin for the long term may opt for the added security of cold wallets. It’s recommended to use a combination of both types of wallets to balance convenience and security.

Final words

Bitcoin, in a broader perspective, is more than just a digital currency; it represents a paradigm shift in the world of finance. It is a technology that challenges the foundations of our current financial system and offers a novel way to think about money and value. As we witness growth in the use of cryptocurrencies, it brings along the need for consumers to educate themselves about how to securely manage and store their digital assets.

The decision to use a hot or cold wallet, or a combination of both, can significantly impact the security of one’s digital assets. While hot wallets provide ease of transaction, cold wallets secure long-term storage. Therefore, it highly depends on individual needs and preferences. Whatever the choice may be, it is vital to ensure the utmost security and confidentiality of private keys, which are essentially the access keys to your digital wealth.

In conclusion, the world of cryptocurrencies, with Bitcoin at its forefront, holds immense possibilities and challenges. As the financial landscape evolves, it is important for individuals and institutions to adapt, innovate, and navigate the way forward with due diligence and strategic foresight. Understanding the intricacies of Bitcoin wallets, hot and cold alike, is just one aspect of this complex and fascinating journey.