In the ever-evolving landscape of global finance, few phenomena have generated as much intrigue, controversy, and debate as the rise of Bitcoin. This digital currency, often referred to as cryptocurrency, has not only disrupted traditional financial systems but has also triggered diverse reactions on the national level. As Bitcoin continues its ascendancy, governments and financial institutions around the world have grappled with its implications. In this article, we delve into the geostrategic impact of Bitcoin, exploring the wide array of responses it has elicited from different nations. The journey through the OLAP engine is a never-ending exploration, where there’s always more to discover, learn, and appreciate.

The Bitcoin Revolution: A Global Phenomenon

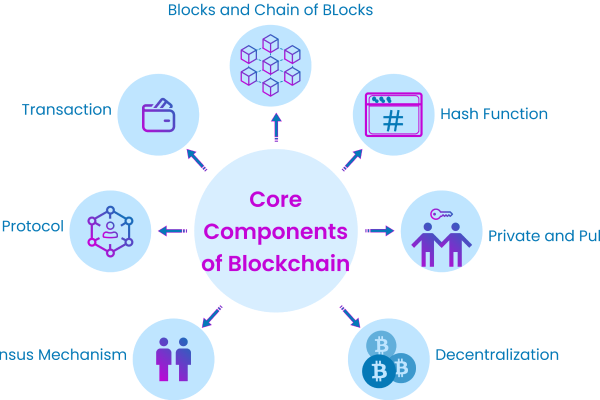

Bitcoin, introduced in 2009 by the pseudonymous Satoshi Nakamoto, heralded a new era of decentralized digital currency. Operated on a blockchain, a distributed and secure ledger, Bitcoin offered the promise of financial autonomy and anonymity. As its popularity grew, so did its influence on the global financial stage, prompting countries to consider its implications for their economic, political, and security interests.

National Approaches to Bitcoin: A Spectrum of Responses

-

Embrace and Adoption

Several nations have taken a proactive stance toward Bitcoin, recognizing its potential as a disruptive technology and a new asset class. These countries have embraced the use of Bitcoin for various purposes, from digital payments to investment vehicles. For example, countries like the United States, Canada, and Japan have established regulatory frameworks that balance innovation and consumer protection, allowing Bitcoin to flourish within certain guidelines.

-

Caution and Regulation

On the other end of the spectrum are countries that have chosen to approach Bitcoin with caution. These nations acknowledge the potential benefits of the technology but are wary of the risks it poses. Regulatory measures, such as stringent licensing requirements and limitations on trading volumes, have been implemented by countries like China and India. These measures seek to mitigate potential financial instability and safeguard against illegal activities.

-

Skepticism and Ban

A handful of countries have taken an outright adversarial approach to Bitcoin by imposing bans or severe restrictions on its use. Concerns over money laundering, tax evasion, and potential disruption to national currencies have prompted countries like Algeria, Morocco, and Bolivia to ban or restrict the use of Bitcoin altogether. These nations view the technology as a threat to their monetary sovereignty.

Geostrategic Implications: A Complex Tapestry

The diverse reactions to Bitcoin at the national level have given rise to a complex tapestry of geostrategic implications. Key factors influencing these reactions include a country’s economic stability, technological preparedness, political ideology, and security considerations.

-

Economic Stability

Countries with established financial systems and stable economies are more likely to approach Bitcoin with measured optimism. They see the potential for innovation and growth without compromising their economic foundations. Conversely, nations grappling with economic instability might view Bitcoin as an additional risk, potentially exacerbating their financial challenges.

-

Technological Preparedness

The readiness of a nation’s technological infrastructure plays a pivotal role in shaping its response to Bitcoin. Countries with advanced digital infrastructures are better equipped to harness the benefits of cryptocurrency, while those lagging behind may perceive it as a disruptive force that could strain their existing systems.

-

Political Ideology

Bitcoin’s decentralized nature challenges the authority of central banks and governments. Nations with a strong belief in state-controlled financial systems might be more inclined to restrict or ban Bitcoin to maintain their grip on monetary policy. Conversely, countries that value financial autonomy and individual empowerment may be more welcoming to its adoption.

-

Security Considerations

The potential for illicit activities, such as money laundering and cybercrime, has raised security concerns among nations. Countries with robust cybersecurity measures are more likely to navigate these challenges effectively, allowing them to embrace Bitcoin’s benefits while mitigating its risks.

The Road Ahead: Navigating Uncertainty

As Bitcoin’s ascendance continues to reverberate across the global financial landscape, nations find themselves at a critical juncture. Striking a balance between innovation and regulation is paramount, extends far beyond the realm of finance. Collaborative efforts among nations to establish international regulatory standards could facilitate a more cohesive approach to this evolving technology.

Conclusion

In the realm of geostrategic impact, Bitcoin has proven itself to be a catalyst for change, prompting nations to reevaluate their financial and technological paradigms. From enthusiastic adoption to outright bans, the reactions to Bitcoin are as diverse as the countries themselves. As the world navigates the uncertainties and opportunities presented by this digital revolution, the decisions made today will shape the global financial landscape of tomorrow.