In the ever-evolving landscape of finance, cryptocurrency has emerged as a disruptive force with the potential to reshape the global economy. While traditional financial institutions have long held sway, the advent of digital currencies and blockchain technology has introduced a new paradigm. If you want to begin trading the right way, you need to gather as much information as possible about the asset you’re planning to invest in. Register here now!

The Rise of Cryptocurrency: Revolutionizing Finance and Economic Inclusion

The concept of cryptocurrency isn’t entirely new, but it was Bitcoin that catapulted it into the mainstream in 2009. Since then, the crypto space has witnessed exponential growth, expanding beyond Bitcoin to include thousands of alternative cryptocurrencies, each with unique features and use cases. The rise of cryptocurrency has coincided with the growing disillusionment with traditional banking systems and centralized financial institutions. As a result, people are turning to digital currencies for their financial needs.

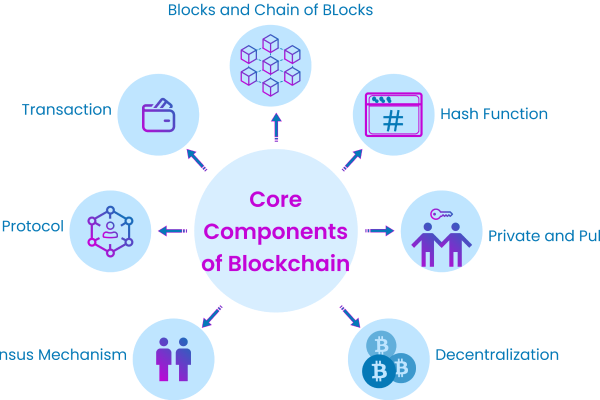

Blockchain Technology: The Backbone of Cryptocurrency

At the heart of the cryptocurrency revolution lies blockchain technology. Blockchain is a decentralized, immutable ledger that records all transactions across a network of computers. It offers transparency, security, and efficiency, making it a compelling alternative to traditional financial infrastructure. Moreover, it eliminates the need for intermediaries, such as banks, to validate and facilitate transactions. This technology has paved the way for innovative applications in various industries, from supply chain management to healthcare, but its most disruptive impact has been in finance.

The Democratization of Finance

Cryptocurrency has the potential to democratize finance in ways previously unimaginable. Traditional financial systems have often excluded those who lack access to banking services or live in areas with underdeveloped financial infrastructure. Cryptocurrency, on the other hand, is accessible to anyone with an internet connection. It allows people to take control of their finances, free from the constraints of traditional banking systems and centralized authorities.

Financial Inclusion: Bridging the Gap

One of the most promising aspects of cryptocurrency is its potential to bridge the gap in financial inclusion. An estimated 1.7 billion people worldwide do not have access to traditional banking services, but many of them have access to a smartphone. Cryptocurrency can provide them with a means to engage in financial transactions, save money, and invest in assets. This has the potential to bring economic empowerment to underserved populations around the globe.

Transparency and Security

The traditional financial sector has not been without its fair share of scandals and controversies. Cryptocurrency aims to address these issues by offering transparency and security. Every transaction on a blockchain is recorded and can be verified by anyone, ensuring accountability. Additionally, the cryptographic nature of blockchain technology makes it extremely secure. These qualities are particularly attractive to investors and individuals who seek greater control over their financial assets.

Pioneering Online Trading

Online trading platforms play a crucial role in the cryptocurrency ecosystem. They provide users with a gateway to the world of digital assets, allowing for seamless trading and investment. These platforms often offer a range of features to empower users, including:

- User-Friendly Interface: The interface is designed for simplicity, making it accessible to individuals of all levels of expertise.

- Advanced Trading Tools: Experienced traders can access advanced tools and analytics to make informed investment decisions.

- Security Measures: Security is a paramount concern, ensuring that users’ assets are protected.

- Customer Support: Users have access to round-the-clock customer support to assist with any queries or issues.

The Investment Potential of Cryptocurrency

Investing in cryptocurrency is not limited to tech-savvy individuals. Anyone can start building their investment portfolio. Here are some key reasons why cryptocurrency is becoming an attractive investment option:

- High Potential Returns: The cryptocurrency market has demonstrated significant growth, with some digital assets experiencing substantial gains over a short period.

- Portfolio Diversification: Cryptocurrency can be an excellent addition to a diversified investment portfolio, offering exposure to an entirely new asset class.

- 24/7 Market: Unlike traditional stock markets that have trading hours, cryptocurrency markets are open 24/7, providing flexibility for investors.

- Global Reach: Cryptocurrency investments are not limited by geographic boundaries, allowing investors to explore opportunities worldwide.

Challenges and Regulatory Considerations

While the future of finance with cryptocurrency appears promising, it is not without its challenges. Regulatory concerns, volatility, and security risks still loom large. Governments and financial institutions are working to establish clear guidelines and regulations to address these concerns and protect investors. Finding the right balance between regulation and innovation is a complex task that will require ongoing collaboration between stakeholders.

The Decentralized Future

The cryptocurrency revolution is more than just a shift in technology; it represents a new way of thinking about finance and the global economy. The future of finance is likely to be increasingly decentralized, with individuals having more control over their financial assets and transactions. Online trading platforms are set to play a vital role in this transformation, offering a gateway to this decentralized financial future.

Conclusion

Cryptocurrency and blockchain tech are reshaping finance with democratization, inclusion, and security. Challenges persist, but the global impact is undeniable, promising an exciting transformation in finance.