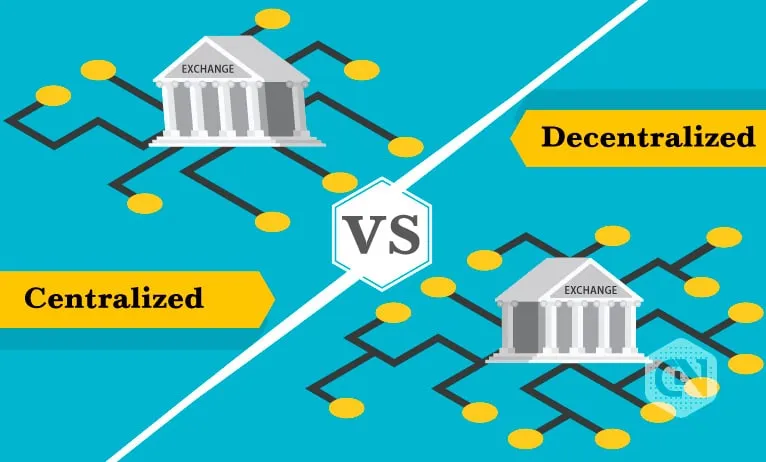

In the dynamic realm of cryptocurrencies, the battle between centralized and decentralized exchanges has emerged as a defining narrative, especially in the context of Bitcoin. Both models offer unique advantages and have stirred intense debates within the crypto community. This article delves deep into the nuances of centralized and decentralized exchanges, shedding light on their implications for Bitcoin trading, security, and the broader landscape of cryptocurrency. If you’re looking for a reliable and user-friendly platform to invest in Bitcoin, check altrix-edge.io and register now!

Centralized Exchanges: Convenience with Trade-offs

The Central Hub of Trading

Centralized exchanges (CEX) are the traditional platforms that have been the cornerstone of cryptocurrency trading. They act as intermediaries, facilitating the exchange of Bitcoin and other cryptocurrencies for users. Well-known exchanges such as Coinbase, Binance, and Kraken fall under this category.

Advantages

Centralized exchanges provide a range of compelling advantages. With their user-friendly and intuitive interfaces, they serve as an excellent option for individuals who are new to the world of cryptocurrencies. The simplicity they offer, combined with their ability to facilitate rapid transactions and ensure high levels of liquidity, has played a significant role in driving their extensive acceptance and usage.

Drawbacks

Nevertheless, the advantage of convenience is accompanied by certain drawbacks. Centralized exchanges face susceptibility to security breaches and cyberattacks due to the storage of users’ private keys on their own servers. The concentration of control in this manner gives rise to apprehensions regarding the privacy of user data and the possibility of service disruptions during periods of high demand.

Decentralized Exchanges: Empowering User Control

A Paradigm Shift

Decentralized exchanges (DEXs) signify a significant transformation within the realm of cryptocurrency trading. Differing from centralized exchanges, DEXs function devoid of a central governing body. Instead, they employ smart contracts to facilitate direct peer-to-peer transactions among users.

Advantages

The key benefit of decentralized exchanges (DEX) is the heightened level of security they offer. By removing the necessity to place trust in a central authority with regards to private keys and funds, individuals can exert better control over their assets. Additionally, DEX are more resistant to hacking attempts due to their decentralized structure.

Drawbacks

While decentralized exchanges (DEXes) provide advanced security features, they frequently encounter challenges such as reduced liquidity and slower transaction speeds in comparison to centralized exchanges. This disparity in transaction speed and liquidity is due to the decentralized nature of DEXes. Moreover, DEXes can present a more intricate user experience, which might discourage individuals who are new to the concept from embracing this decentralized exchange model.

The Battle Continues: Implications for Bitcoin

Liquidity and Price Discovery

Centralized exchanges demonstrate strong performance in terms of liquidity and the process of determining asset prices. This quality arises from their substantial user populations, rendering them particularly attractive to traders who prioritize quick transactions and competitive market rates. However, it’s important to note that the significant accumulation of trading on centralized exchanges can introduce the possibility of market manipulation.

Security and Control

Decentralized exchanges (DEXs) place a strong emphasis on enhancing security measures and granting users greater control over their transactions. These attributes hold particular appeal for Bitcoin traders who hold privacy and autonomy in high regard. DEXs facilitate transactions without the need for intermediaries, aligning with the preferences of these traders. The rapid ascent of decentralized finance (DeFi) has significantly contributed to the widespread adoption of DEXs, further underlining their importance in the evolving financial landscape.

Striking a Balance

As the battle between centralized and decentralized exchanges rages on, it’s becoming apparent that a hybrid model might offer the best of both worlds. Some emerging platforms are striving to combine the convenience of CEX with the security features of DEX. This could potentially mitigate the drawbacks of each approach and pave the way for a more inclusive and robust trading ecosystem.

The Future Landscape

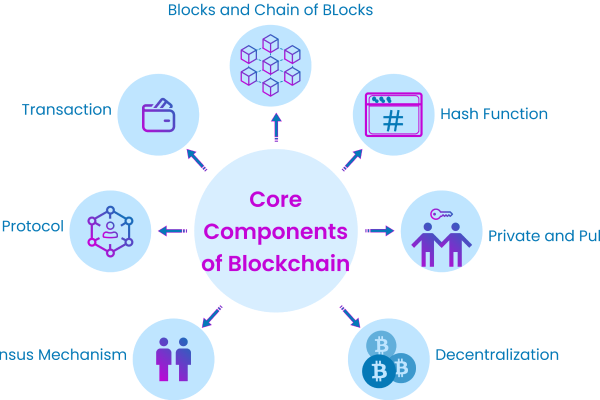

The progression of cryptocurrency exchanges is intricately linked with the prospective development of Bitcoin and the wider cryptocurrency sector. The continuous advancement in blockchain technology is expected to lead to the emergence of new exchange models, aimed at overcoming the existing constraints of both centralized exchanges (CEX) and decentralized exchanges (DEX).

Conclusion

In the ever-evolving landscape of cryptocurrency, the battle between centralized and decentralized exchanges is a pivotal chapter. Bitcoin Era which is an Online trading platform each approach brings its own set of advantages and challenges, catering to different segments of Bitcoin traders. As the industry continues to mature, it’s conceivable that a harmonious coexistence of both models will emerge, driving the next phase of innovation in the realm of crypto trading.