As the world hurtles through the digital age, financial landscapes are undergoing rapid transformations. From the days of physical currency to the emergence of cryptocurrencies like Bitcoin, the journey has been nothing short of revolutionary. In this article, we’ll delve into the intricate evolution of the digital financial landscape, exploring the journey from mere bits of data to the soaring popularity of cryptocurrencies and their flagship representative, Bitcoin. Experience the future of trading by navigating to https://quple.io/ and immersing yourself in our cutting-edge platform

A Digital Revolution Unleashed

The shift from traditional financial systems to digital ones was akin to opening a new dimension. With the advent of the internet transactions that once required physical presence or manual processes could now be executed at the click of a button. The convenience of online banking, electronic fund transfers, and e-commerce became the foundation for a financial revolution.

The Genesis of Cryptocurrencies

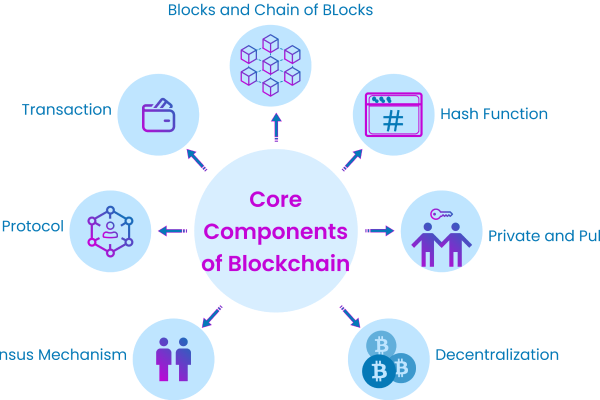

In 2008, an individual using the pseudonym Satoshi Nakamoto unveiled a revolutionary idea through a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” This pivotal moment marked the birth of what we now call cryptocurrencies – digital forms of value constructed upon the principles of blockchain technology. This innovative technology utilizes a decentralized and tamper-resistant ledger system, ensuring the integrity and security of transactions. The advent of blockchain ushered in an era of unparalleled transparency and enhanced security within the realm of financial exchanges.

Understanding Bitcoin’s Ascension

Bitcoin, the pioneer cryptocurrency, gained traction slowly but surely. Its finite supply, decentralized nature, and security features resonated with those seeking an alternative to traditional currencies. Over time, its value surged, and it became not just a digital currency, but a store of value. Investors and enthusiasts started recognizing Bitcoin’s potential to reshape the financial landscape.

Cryptocurrencies and the Financial Ecosystem

The rise of Bitcoin was just the beginning. As blockchain technology evolved, it gave rise to a multitude of cryptocurrencies, each with its unique features and use cases. Ethereum introduced smart contracts, allowing programmable and self-executing agreements. Ripple focused on facilitating cross-border payments. These innovations widened the scope of digital finance.

Bitcoin’s Impact on Investment

Bitcoin’s remarkable price appreciation over the years caught the attention of investors worldwide. Traditional financial institutions that initially dismissed cryptocurrencies as a fad had to reconsider their stance. Bitcoin’s volatility and potential for high returns led to its adoption as a speculative investment. Institutional investors, hedge funds, and even publicly traded companies started including Bitcoin in their portfolios.

Navigating Regulatory Challenges

As cryptocurrencies gained prominence, regulatory challenges emerged. Governments and financial bodies grappled with the classification of cryptocurrencies, taxation, and their potential use in illegal activities. Striking a balance between innovation and regulation became crucial to ensure the security of investors and the stability of the financial ecosystem.

Beyond Bitcoin: Diverse Cryptocurrency Landscape

Bitcoin’s success paved the way for a diverse range of cryptocurrencies, often referred to as “altcoins.” Each of these coins aimed to address specific challenges or offer unique features. Litecoin aimed to facilitate faster transactions, while Cardano focused on creating a sustainable and scalable blockchain platform. The competition and collaboration among these projects continue to shape the digital financial landscape.

Challenges and Opportunities

While the digital financial landscape offers immense opportunities, it’s not without its challenges. Cybersecurity threats, regulatory uncertainties, and market volatility remain concerns. However, the underlying blockchain technology holds promise beyond finance, with applications in supply chain management, healthcare, and more. The evolution of decentralized finance (DeFi) is redefining traditional banking services.

Looking Ahead: The Future of Finance

The journey from bits of data to cryptocurrencies like Bitcoin has been exhilarating, but it’s far from over. The future of finance holds possibilities we can only begin to fathom. Central bank digital currencies (CBDCs) are becoming a reality, blurring the lines between traditional and digital currencies. The integration of AI and blockchain could lead to more efficient financial processes.

Conclusion

In the grand tapestry of the digital financial landscape, Bitcoin stands as a pivotal thread. Its creation marked the genesis of a new era, one characterized by decentralized, secure, and borderless financial transactions. As we continue to sculpt this landscape, the fusion of technology and finance will shape how we interact with money, invest our assets, and envision the concept of value itself.As you ponder the intricate dance between innovation and tradition, remember that the journey from bits to Bitcoin is a testament to human ingenuity and our ceaseless pursuit of progress.